Bearer bonds are a type of fixed-income security that is issued as a physical certificate. Unlike traditional bonds, bearer bonds do not have the owner’s name or any other identifying information on them. Instead, the person who holds the physical certificate is considered the owner of the bond.

Bearer bonds are unique in that they offer the holder complete anonymity. This means that anyone who holds the bond can cash it in, regardless of whether or not they are the original purchaser. Because of this, bearer bonds are often used for illegal or illicit purposes, such as money laundering or tax evasion.

Despite their anonymity, bearer bonds are still subject to the same risks and considerations as traditional bonds. These include credit risk, interest rate risk, inflation risk, and liquidity risk. However, because bearer bonds are not registered, they are also subject to additional risks, such as theft and loss.

Key Takeaways

- Bearer bonds are a type of fixed-income security that is issued as a physical certificate.

- Bearer bonds offer complete anonymity to the holder, which makes them attractive for illegal purposes.

- Bearer bonds are subject to the same risks and considerations as traditional bonds, as well as additional risks due to their lack of registration.

Definition of Bearer Bonds

Whoever physically holds a bearer bond is the owner of that bond. They are unregistered bonds, and the holder of the bond is not recorded anywhere. Bearer bonds are also known as bearer securities, and they are issued in physical form, usually as a certificate.

Characteristics

Bearer bonds have several characteristics that distinguish them from other types of bonds. One of the most significant characteristics is that they are unregistered, which means that the issuer does not keep a record of who owns the bond. Instead, whoever holds the bond is its owner. The bond is a bearer bond, and it will not carry on the name of the original purchaser. In order to protect the identity of the holder of the bond, the special bearer bond shall be kept in a safe place.

Another characteristic of bearer bonds is that they are transferable. The holder of the bond can sell or transfer the bond to another person without notifying the issuer. This makes bearer bonds more flexible than registered bonds, which require the issuer to update their records whenever the ownership of the bond changes.

Legal Framework

Bearer bonds have been used for many years, and they are legal in many countries. However, in recent years, some countries have banned the issuance of bearer bonds due to concerns about money laundering and tax evasion. For example, the European Union banned the issuance of bearer bonds in 2015.

In the United States, bearer bonds are legal, but they are subject to certain restrictions. For example, the IRS requires that the interest on bearer bonds be reported as income, even if the bondholder does not receive a 1099 form. Additionally, some states have laws that require the issuer of a bearer bond to maintain a record of the bondholder’s name and address.

Overall, bearer bonds are a unique type of bond that offers some advantages over other types of bonds. However, they also come with some risks and restrictions, and investors should carefully consider these factors before investing in bearer bonds.

Issuance and Trading

Bearer bonds are a type of debt security that is owned by whoever physically holds the bond certificate. They are issued by corporations, governments, and other entities as a way to raise capital. The process of issuance and trading of bearer bonds is different from other types of bonds, such as registered bonds, which are owned by whoever is listed in the bond’s registry.

Issuance Process

The issuance of bearer bonds is a complex process that involves several steps. First, the issuer must determine the terms of the bond, including the interest rate, maturity date, and principal amount. Once these terms are determined, the issuer must prepare the bond certificate, which is a physical document that represents ownership of the bond.

The bond certificate is then sold to investors through an underwriter, who is responsible for marketing the bonds to potential buyers. The underwriter will typically purchase the bonds from the issuer at a discount and then resell them to investors at a higher price, earning a profit on the difference.

Secondary Market

After the initial issuance, bearer bonds can be traded on the secondary market. This market is made up of investors who buy and sell bonds among themselves, rather than buying directly from the issuer. The secondary market allows investors to buy and sell bonds at market-determined prices, rather than being limited to the price set by the issuer at the time of issuance.

Trading in the secondary market can be done through brokers or dealers, who facilitate the buying and selling of bonds among investors. The price of a bond on the secondary market is determined by a variety of factors, including the creditworthiness of the issuer, the prevailing interest rates, and the supply and demand for the bond.

Overall, the issuance and trading of bearer bonds can be a lucrative investment opportunity for investors who are willing to assume the risks associated with this type of security. However, investors should carefully consider the terms of the bond and the creditworthiness of the issuer before investing in bearer bonds.

Risks and Considerations

When considering investing in bearer bonds, it is important to be aware of the potential risks involved. This section will explore some of the key risks and considerations that investors should keep in mind.

Default Risk

One of the main risks associated with bearer bonds is default risk. Because bearer bonds are not registered in the name of the owner, there is no way to track who owns them. This means that if the issuer defaults on the bond, there is no way for the issuer to contact the bondholder to inform them of the default. As a result, bondholders may not be aware of the default until it is too late to take action.

To mitigate this risk, investors may want to consider investing in registered bonds instead. Registered bonds are registered in the name of the owner, which means that the issuer can contact the bondholder if there is a default.

Anonymity Concerns

Another consideration when investing in bearer bonds is anonymity concerns. Because bearer bonds are not registered in the name of the owner, they can be used to anonymously transfer large sums of money. This anonymity can make bearer bonds attractive to individuals who are looking to engage in illegal activities such as money laundering.

To address this concern, some countries have banned the issuance of bearer bonds altogether. For example, in the United States, the issuance of bearer bonds has been banned since 1982.

Tax Implications

Investors should also be aware of the tax implications associated with investing in bearer bonds. Because bearer bonds are not registered in the name of the owner, there is no way for the issuer to track who owns them. This means that bondholders may not receive tax reporting documents, such as 1099 forms, from the issuer.

As a result, bondholders may be responsible for tracking their own interest income and reporting it on their tax returns. This can be a time-consuming process and may result in errors if bondholders are not careful.

Overall, while bearer bonds can offer certain advantages, such as anonymity and ease of transfer, they also come with significant risks and considerations that investors should be aware of. By understanding these risks and taking steps to mitigate them, investors can make informed decisions about whether or not to invest in bearer bonds.

Historical Context

Bearer bonds have a long and fascinating history, dating back to the 18th century. They were popular in the early 20th century, with many governments and corporations issuing them to raise funds. This section will provide an overview of the historical context of bearer bonds, including their origins, evolution, and decline in popularity.

Origins and Evolution

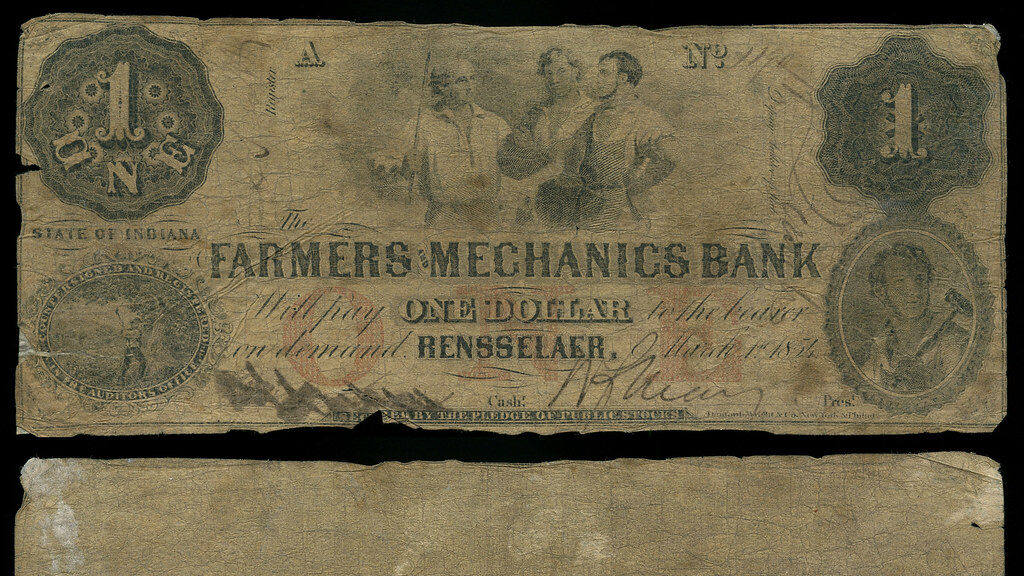

Bearer bonds were first issued in the 18th century as a way for governments to raise funds. They were called “bearer” bonds because the person who held the bond was considered the owner and was entitled to the interest payments. At that time, bearer bonds were typically issued as physical certificates, which were often traded on stock exchanges.

Over time, bearer bonds evolved to become more complex financial instruments. In the early 20th century, corporations began issuing bearer bonds as a way to raise funds for expansion and investment. Governments also continued to issue bearer bonds as a way to finance infrastructure projects and other initiatives.

Decline in Popularity

Despite their popularity in the early 20th century, bearer bonds began to fall out of favor in the latter half of the century. One reason for this was the increased regulation of financial markets, which made it more difficult for corporations and governments to issue bearer bonds. Additionally, the rise of electronic trading and the increased use of digital financial instruments made bearer bonds less necessary.

Today, bearer bonds are relatively rare, with most governments and corporations issuing registered bonds instead. Registered bonds are similar to bearer bonds, but they are issued in the name of the owner and are typically traded electronically.

In conclusion, bearer bonds have a long and fascinating history, but their popularity has waned in recent decades. While they were once a popular way for governments and corporations to raise funds, they have been largely replaced by registered bonds and other financial instruments.

Frequently Asked Questions

What purposes do bearer bonds serve in financial transactions?

Bearer bonds are a type of bond that does not have the owner’s name recorded with the issuer. Instead, the person who possesses the bond is presumed to be the owner. Bearer bonds are used to facilitate anonymous transactions and to avoid the need for a registered transfer of ownership. They can be transferred by delivery alone, making them a popular choice for investors who value privacy and convenience.

Which countries currently issue bearer bonds?

Bearer bonds are still issued by some countries, including Switzerland, Luxembourg, and Liechtenstein. However, many countries have phased them out due to concerns about money laundering and tax evasion. The United States, for example, stopped issuing bearer bonds in 1982.

How can one determine the value of a bearer bond?

The value of a bearer bond is determined by its face value, which is the amount of money that the bond will be worth when it matures. Bearer bonds typically pay interest at a fixed rate, which is also stated on the bond. To calculate the value of a bearer bond at any given time, one must factor in the remaining time until maturity and the prevailing interest rates in the market.

Are bearer bonds still legally recognized in the United States?

Bearer bonds are no longer legally recognized in the United States. The Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) eliminated the tax advantages of holding bearer bonds, and the U.S. Treasury stopped issuing them in the same year. Existing bearer bonds can still be redeemed, but they must be reported to the IRS and the owner’s identity must be verified.

What is the process for redeeming old bearer bonds?

The process for redeeming an old bearer bond depends on the specific bond and the issuer. In general, the bondholder must present the physical bond certificate to the issuer or a designated agent, along with proof of identity. The issuer will then verify the bond and pay out the face value plus any accrued interest.

How can bearer bonds be converted into cash?

Bearer bonds can be converted into cash by redeeming them with the issuer or selling them on the secondary market. However, since bearer bonds are not registered with the issuer, the seller must find a buyer who is willing to purchase the bond without knowing the identity of the owner. This can make it difficult to sell bearer bonds, especially in today’s market where most investors prefer registered securities.