“Black Swan,” a term used in financial markets, denotes an unforeseen event with significant repercussions that we usually recognize only after the fact. If we apply this concept to the housing sector, a “Black Swan” market crash would feature investors and homeowners alike caught off guard by sudden and severe plunges in real estate values.

Despite its reputation for stability as an investment option, these events demonstrate how vulnerable our perception of the housing market can be; indeed, such crashes have far-reaching implications not just for individual property owners but also for broader economic conditions. According to a 2023 study by Harvard University, unexpected economic downturns have historically led to a rapid decline in housing market stability.

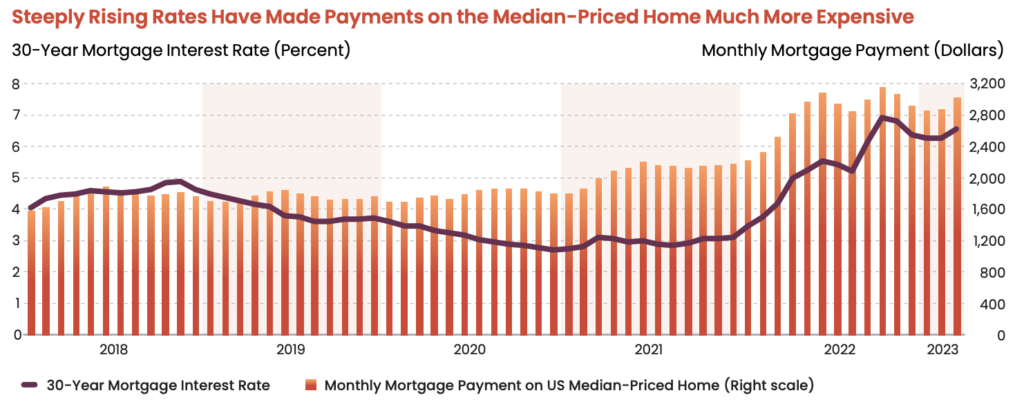

Examining historical data and market trends can offer insight into potential precursors of Black Swan events, which by nature are challenging to anticipate or prepare for due to their inherent unpredictability. Potential instability may be looming in the market as several indicators—rising interest rates and inflated home prices, for instance—signify a possible significant correction on the horizon. A significant correction could impact liquidity and property values and potentially initiate further financial challenges. Stakeholders can navigate the aftermath and implement risk management strategies more effectively by understanding the mechanics and fallout of past crashes.

Key Takeaways

- A Black Swan in the housing market is a sudden and significant downturn.

- Indicators such as rising interest rates may signal potential instability.

- Understanding past events can aid in navigating and mitigating the fallout.

What are Black Swan Events?

Black Swan events are unpredictable and have a big impact on the financial and housing markets. They can cause major changes and are important for making decisions in these areas. A black swan event is something very unusual that has a big effect, and usually people only understand it after it happens. These events are known for their:

- Unpredictability, because they cannot be predicted beforehand with any meaningful accuracy.

- Severe consequences, because they have the potential to cause catastrophic effects on the economy.

Recent studies highlight the significant influence of Black Swan events, such as the Global Financial Crisis of 2007–08 and the COVID-19 pandemic, on housing markets worldwide. A study by Wong et al. (2024) found that the Australian housing market experienced unprecedented high house price indices towards the end of 2021, despite the economic turmoil caused by the pandemic. The research suggests that quantitative easing policies, aimed at boosting liquidity in the market, played a critical role in sustaining house prices during these turbulent times. This study sheds light on the complex relationship between monetary policy, housing finance, and market performance during Black Swan events, emphasizing the importance of evaluating the efficacy of fiscal policies in stabilizing housing markets (Emerald Insight, 2023).

Historical Examples in Housing Markets

The housing market has not been immune to black swan events. Historical instances have included:

- 2008 Housing Market Crash: A dramatic decline in U.S. housing prices triggered a global financial crisis.

- Dot-Com Bubble Burst: While broader than just housing, its bust in the early 2000s affected overall economic sentiment and had repercussions for the housing market.

For further reading on black swan events, including specific examples in the housing market, you may consider these comprehensive accounts: Investorplace, Deseret News, and Seeking Alpha.

Precursors of a Black Swan Housing Market Crash

To understand the precursors of a potential Black Swan event in the housing market, one must scrutinize not only broad economic indicators but also signals specific to real estate.

Typically, key economic metrics serve as early warning signs of a housing market downturn; these include. For example, high unemployment can reduce consumer purchasing power, leading to fewer home buyers. Rising interest rates escalate borrowing costs, potentially cooling off housing demand.

Within the real estate market itself, certain indicators are warnings of a potential crash. For example, a rapid surge in housing inventory may indicate a surplus; this, in turn, exerts downward pressure on prices. Inflated prices relative to income levels can forecast a market correction as affordability diminishes under pressure.

What Happens After the Black Swan Crash?

A dramatic decrease in home equity may afflict homeowners, potentially culminating in negative equity—a scenario where the mortgage debt surpasses the property’s value. This situation often triggers a surge of foreclosures; such was evident during the 2008 financial crisis. Home buyers might experience tightening availability of mortgages and unpredictable fluctuations in interest rates; these factors can escalate costs or complicate acquisition, thus making home loans more expensive or harder to obtain.

Consequences for the Global Economy

The ripple effects of a housing market crash on the global economy can be profound. Financial institutions might experience substantial losses due to loan defaults and diminishing mortgage-backed securities. This downturn could trigger a decrease in housing construction, an essential driver for economics, leading consequently to elevated unemployment rates and reduced consumer expenditure.

Policy Responses and Interventions

Typically, governments and central banks enact a variety of interventions in response to a housing market crash; these actions may encompass: lowering interest rates—an initiative aimed at encouraging borrowing and thus stimulating the economy. Secondly, they might implement programs designed to assist homeowners facing foreclosure. Finally, but not least importantly, is their role in preventing systemic collapse by bailing out financial institutions.

After a housing market crash, both individuals and institutions must actively embrace targeted strategies for recovery. The crucial role in stabilizing the aftermath is played by careful management of personal finances; furthermore, proactive policy measures become imperative, not only to restore equilibrium but also to prevent future crises.

For individuals, the primary focus is on stabilizing their financial situation. Homeowners can explore mortgage modification programs to make their loans more manageable. Renters should seek assistance from local housing aid groups. Consider the following steps:

- Evaluate and adjust the budget. Prioritize essential expenses and consider negotiating with lenders to lower payments.

- Seek professional advice. Financial counselors can offer guidance on debt management and asset protection.

Government and Financial Sector Roles

The government and financial sectors must work together to help the economy recover and restore people’s trust in consumption. They need to act clearly with steps like implementing monetary policies, for example, interest rate adjustments, to facilitate affordable lending. They must also provide financial help and start initiatives such as funds for urgent housing needs to stop people from becoming homeless and to encourage building work and employment.

It is also necessary to enforce rules so that lending activities are responsible and clear, as well as to create new financial products that are stronger against unexpected ‘Black Swan’ events in the future.

Preventive Measures and Risk Management

Good strategies for managing risk are very important to lessen the possible effects of a crash in the housing market. People and organizations can do certain things to prepare for unexpected major changes that might happen in property markets.

Individual Financial Planning

People need to pay attention to keeping their own money strong. It’s good for them to spread out the kinds of investments they have, not just in property, so there is less chance of losing money. Furthermore, they are able to keep significant emergency savings that should be enough for 6 to 12 months of the cost of living; this helps protect them if the market goes down. Holding back from getting too much debt, and particularly debt with changing rates, is also wise because it lessens their risk from interest rates that change often.

Institutional Safeguards

Organizations can put in place strong measures like thorough stress tests to prepare for unexpected situations. They should also do consistent reviews of how they lend money and what loans they have to stay alert for possible dangers. Furthermore, using sophisticated analysis and past data can give early alerts of a market downturn and allow for quicker reaction actions. Institutions ought to promote careful lending habits too, making certain that borrowers possess the ability to pay back their debts even when the market is not stable.

Frequently Asked Questions

This part talks about frequent questions people have about the chance of a housing market falling down. It gives understanding based on what happened in history, ways to get ready for it, and how unexpected things can affect houses and property businesses.

What are the indicators of an impending housing market crash?

Generally, when a housing market is about to crash, you see house prices go up very fast, more people are unable to pay their mortgages, and it becomes much harder for most to buy houses. Also, if interest rates are going higher and people feel less sure about spending money, these can be signs that the market might go down soon.

How can investors prepare for a potential black swan event in real estate?

Investors should get ready by spreading their investments, keeping some cash available, and keeping up with market updates. Having a plan for managing risk is essential, and thinking about long-term investment goals can help you cope with possible ups and downs in the market.

What historical examples of black swan events have impacted the housing market?

The housing market collapse in 2008 is widely recognized as an unexpected black swan occurrence. It surprised a lot of people because the house prices fell quickly, leading to a financial crisis all over the world.

In what ways do black swan events affect real estate investments?

Black swan events might cause sudden drops in value, make the market more unstable, and create less cash flow. These situations usually turn things into a buyer’s market because there are more properties available than people who want to buy them, which makes the prices of houses and real estate investments go down.

Why is the COVID-19 pandemic considered a black swan event for the real estate market’s effects?

The pandemic of COVID-19 is like a rare and unexpected incident because it started changes in the world economy that were very big, with governments stepping in a lot. It changed how much people want houses, their ability to pay rent, and the use and worth of property spaces.

Is it possible for unexpected events in the housing market to lead to good results, and can you provide some instances of this?

While black swan events are often thought of negatively, they can result in good things like changes to regulations and adjustments in the markets. For example, the new rules after 2008 provided better controls for giving loans and watching over the housing financial situation.