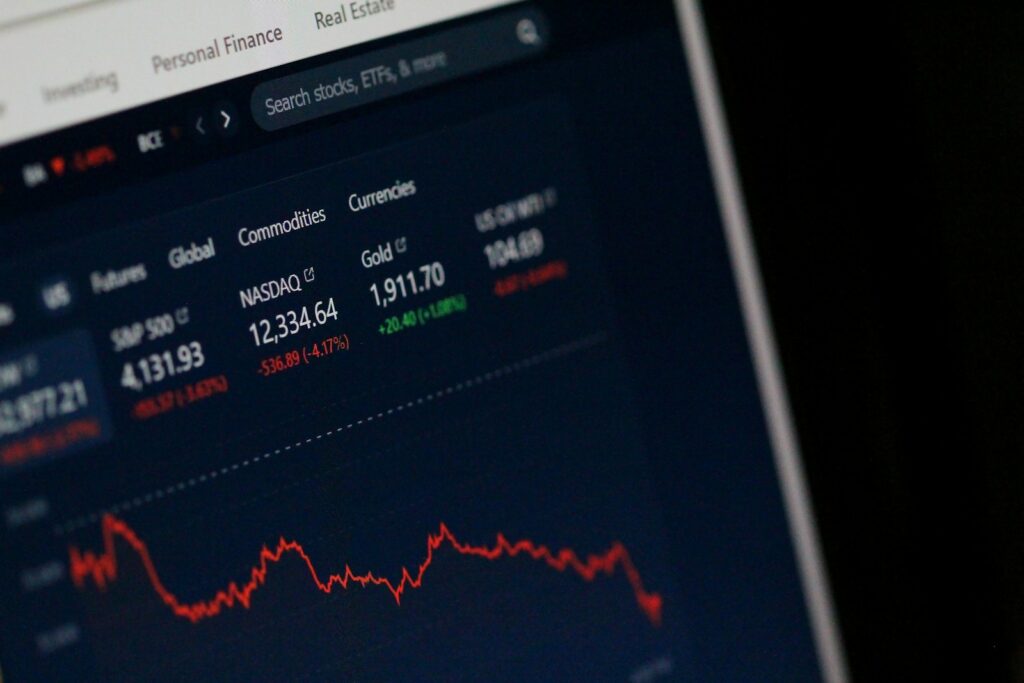

Posted inInvesting

What Is Multi-Asset Investing? Diversification Across Asset Classes Explained

Multi-asset investing is a strategy that diversifies an investment portfolio across various asset classes. This approach goes beyond the traditional method of focusing on a single class, such as stocks or bonds, to include a mix of equities, fixed income, real estate, commodities, and sometimes alternative investments. By allocating funds across different assets, investors aim to enhance returns while managing risk, as the performance of asset classes often does not move in sync. A key principle of multi-asset investing is…