Voiding a check is a process that involves canceling a check that has been written but not yet cashed. Voiding a check is a necessary step in case of errors or mistakes, such as writing the wrong amount or payee. Voiding a check is also an important step in cases of check fraud, as it renders the check useless and prevents unauthorized individuals from cashing it.

Understanding checks is the first step in voiding a check. Checks are financial instruments that are used to transfer funds from one person or entity to another. Checks contain important information such as the name of the payee, the amount of the payment, and the signature of the person who wrote the check. Understanding the different parts of a check is important in order to correctly void a check.

Steps to void a check may vary depending on the bank or financial institution, but generally involve writing the word “VOID” in large letters across the face of the check, including the date, and the reason for voiding the check. It is important to keep a record of the voided check and the reason for voiding it. Voided checks can be used as proof of payment or as a record of a canceled transaction.

Key Takeaways

- Understanding the different parts of a check is important in order to correctly void a check.

- Steps to void a check may vary depending on the bank or financial institution.

- Voided checks can be used as proof of payment or as a record of a canceled transaction.

Understanding Checks

Checks are a standard form of payment that individuals and businesses use to pay bills, purchase goods, and transfer money. A check is a written order to a bank to pay a specific amount of money to a specific person or entity. Voiding a check means that the check is no longer valid and cannot be cashed or deposited.

Purpose of a Voided Check

A voided check is used for a variety of reasons. One of the most common reasons is to provide a voided check to an employer for direct deposit of paychecks. Employers require voided checks to ensure that the correct bank account and routing number are used for direct deposit. Another reason for voiding a check is to cancel a payment that was previously authorized.

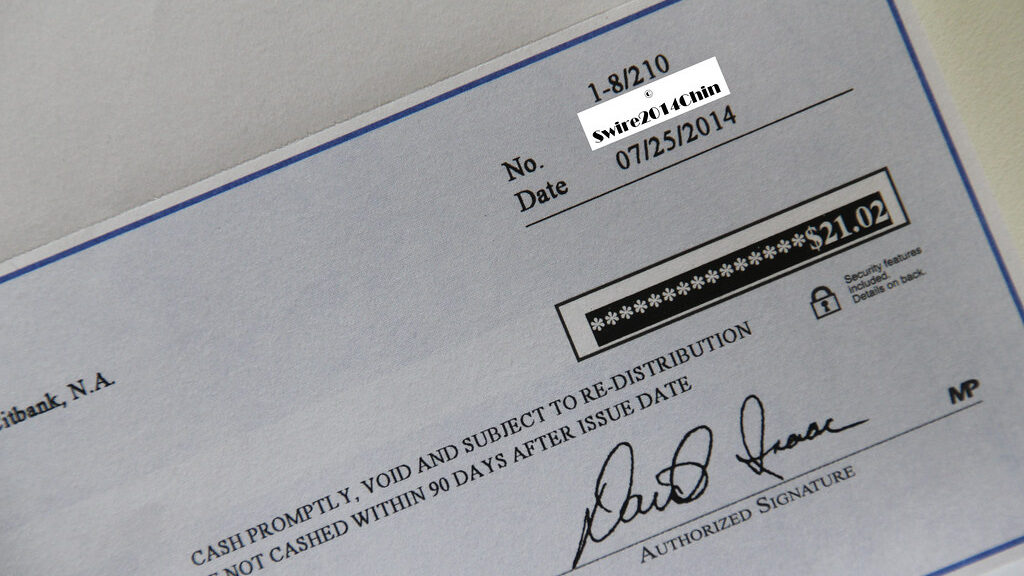

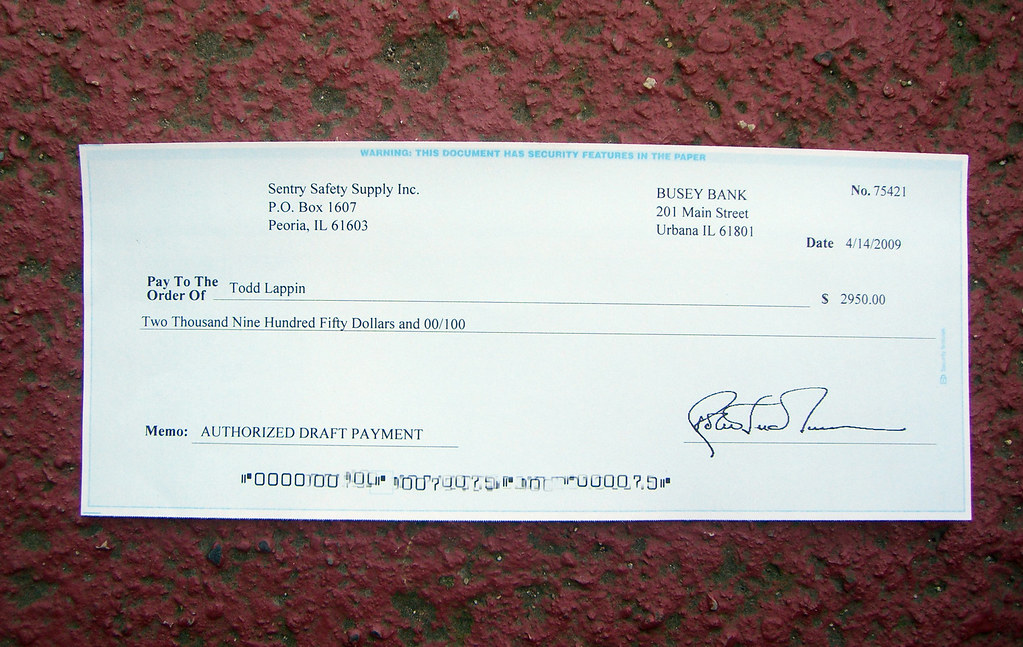

Parts of a Check

To understand how to void a check, it is essential to know the different parts of a check.

Check Number

The check number is a unique identifier for each check. It is located in the upper right-hand corner of the check and is used to track payments.

Date

The date is the day the check was written. It is located in the upper right-hand corner of the check and is used to determine when the check can be cashed.

Payee

The payee is the person or entity that is authorized to receive the payment. The payee’s name is written on the line that says “Pay to the order of.”

Amount

The amount is the numerical value of the payment. It is written in both numerical and written form on the check.

Memo

The memo is an optional field used to provide additional information about the payment. It is located in the lower left-hand corner of the check.

Signature

The signature is the authorization for the payment. It is located in the lower right-hand corner of the check and is signed by the account holder.

To void a check, the account holder should write “VOID” in large letters across the front of the check. It is essential to ensure that the entire check is marked as void, including the signature, date, and payee information. This will prevent anyone from attempting to cash or deposit the check.

Steps to Void a Check

Voiding a check is a simple process that can be done in a few easy steps. Voiding a check is necessary when a check has been written incorrectly or needs to be canceled. Below are the steps to void a check:

Writing ‘VOID’ on the Check

The first step in voiding a check is to write the word “VOID” in large letters across the front of the check. This ensures that the check cannot be cashed or deposited. Writing the word “VOID” on the check also serves as a record of the voided check.

Record Keeping for Voided Checks

It is important to keep a record of all voided checks for accounting purposes. This can be done by creating a log of voided checks or by keeping the voided check with the original check stub. The log should include the check number, date, payee, and reason for voiding the check. Keeping a record of voided checks is important for tracking expenses and ensuring that all checks are accounted for.

Voiding a check is a simple process that can be done in a few easy steps. It is important to write the word “VOID” in large letters across the front of the check and keep a record of all voided checks for accounting purposes. By following these steps, you can ensure that your financial records are accurate and up to date.

Using Voided Checks

Voided checks are an essential tool for managing personal finances. They can be used to set up direct deposit or electronic payment authorization. Here are some tips for using voided checks effectively.

Setting Up Direct Deposit

Direct deposit is a convenient way to receive payments from an employer or other organization. To set up direct deposit, you will need to provide your bank account number and routing number to the organization. You can find this information on your checks.

To ensure that your direct deposit is set up correctly, it is a good idea to provide a voided check to the organization. This will allow them to verify that they have the correct account information. Simply write “VOID” across the check and provide it to the organization.

Electronic Payment Authorization

Electronic payment authorization is another convenient way to manage personal finances. It allows you to pay bills and make other payments automatically from your bank account. To set up electronic payment authorization, you will need to provide your bank account number and routing number to the organization.

To ensure that your electronic payment authorization is set up correctly, it is a good idea to provide a voided check to the organization. This will allow them to verify that they have the correct account information. Simply write “VOID” across the check and provide it to the organization.

In conclusion, voided checks are an important tool for managing personal finances. They can be used to set up direct deposit or electronic payment authorization. By following these tips, you can ensure that your direct deposit and electronic payment authorization are set up correctly.

Preventing Check Fraud

Check fraud is a serious issue that can lead to significant financial loss. To prevent check fraud, there are several steps that individuals and organizations can take.

Proper Disposal of Voided Checks

One of the most important steps in preventing check fraud is to properly dispose of voided checks. When a check is voided, it should be marked as such and then destroyed. This can be done by shredding the check or burning it. Simply throwing the check in the trash can make it easy for fraudsters to retrieve it and use it for fraudulent purposes.

Secure Storage of Checkbooks

Another important step is to store checkbooks in a secure location. Checkbooks should be kept in a locked drawer or cabinet, and access should be limited to authorized individuals only. It is also important to keep track of the number of checks in the checkbook, so that any missing checks can be reported and monitored for fraudulent activity.

By taking these steps, individuals and organizations can help prevent check fraud and protect their financial assets.

Frequently Asked Questions

What are the steps to void a check for direct deposit setup?

To void a check for direct deposit setup, the account holder should write “VOID” in large, bold letters across the front of the check. It is important to avoid writing anything else on the check, as this could interfere with the direct deposit process. Once the check has been properly voided, the account holder can provide it to their employer or other relevant party to set up direct deposit.

Can a voided check be used for any unauthorized transactions?

No, a voided check cannot be used for any unauthorized transactions. By writing “VOID” across the front of the check, the account holder is indicating that the check is no longer valid and should not be used for any purpose. However, it is still important to keep the voided check in a safe place to prevent any potential fraud or misuse.

Is there a fee associated with obtaining a voided check from a bank?

Banks may charge a fee for obtaining a voided check, but this varies depending on the bank and the account type. Some banks may offer a certain number of free checks per month or year, while others may charge a flat fee for each check requested. It is important to check with your bank to determine their specific policies and fees.

What is the proper way to mark a check as void to prevent its use?

To properly mark a check as void, the account holder should write “VOID” in large, bold letters across the front of the check. It is important to avoid writing anything else on the check, as this could interfere with the voiding process. Additionally, the account holder should ensure that the check is not torn or damaged in any way, as this could also interfere with the voiding process.

How can I obtain a voided check from my online banking account?

To obtain a voided check from an online banking account, the account holder should log in to their account and navigate to the section for check requests or check printing. From there, they can select the option to print a voided check. It is important to ensure that the voided check is printed on a blank piece of paper and not on a previously used check.

Should a signature be included on a voided check for verification purposes?

No, a signature is not necessary on a voided check for verification purposes. By writing “VOID” across the front of the check, the account holder is indicating that the check is no longer valid and should not be used for any purpose. However, it is still important to keep the voided check in a safe place to prevent any potential fraud or misuse.