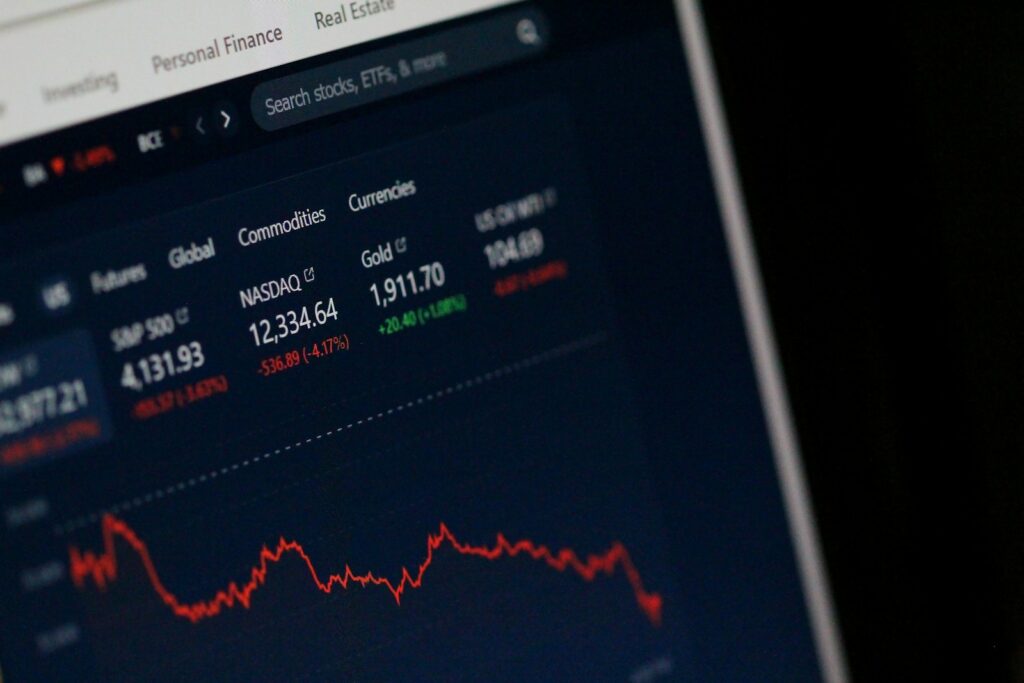

Posted inStock Market

Best Day Trading Simulators

In the last few years, many people have become interested in day trading as a way to make money from small changes in the markets over short periods of time. It needs special skills and a thorough knowledge of market signs, plus quick responses to changes in the market. However, for beginners and also those traders with more experience who want to improve their techniques, starting day trading can bring a significant risk of losing money. Day trading simulators are…