Posted inInvesting

What is Woke Investing?

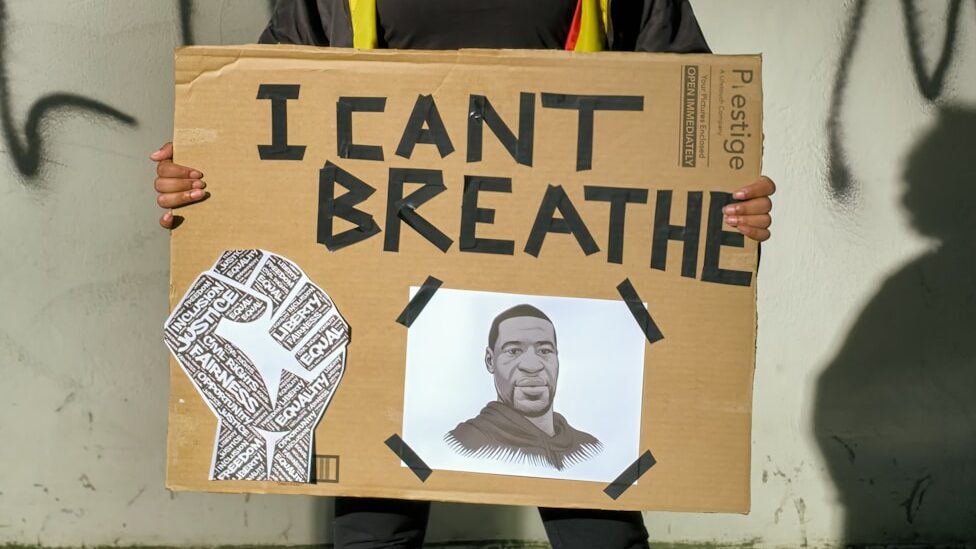

Woke investing refers to investment strategies that incorporate environmental, social, and governance (ESG) considerations into the decision-making process. Woke investing considers social and ethical factors alongside financial returns. Beyond the traditional aim of seeking financial returns, woke investing places a deliberate focus on supporting companies that align with certain ethical standards or societal goals. For example, these goals may include reducing carbon emissions, promoting workplace diversity, or upholding human rights. It reflects a growing movement to align personal values with…