Posted inBusiness

CapEx vs OpEx

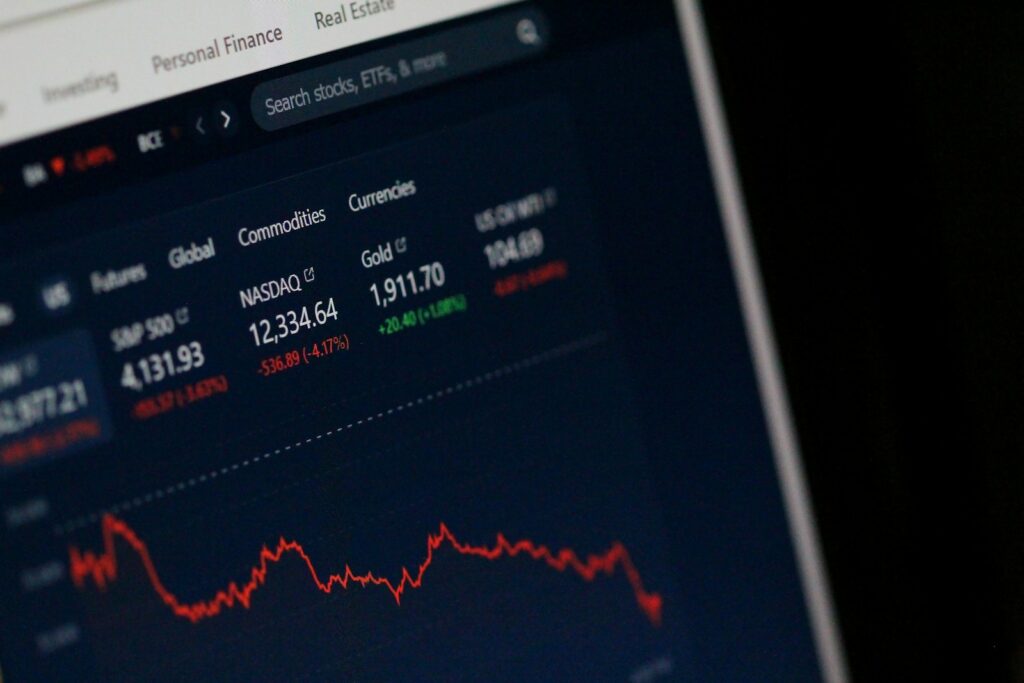

Capital expenditures (CapEx) and operational expenditures (OpEx) are two important financial metrics that businesses use to manage their finances. CapEx refers to the money that a company spends on acquiring or upgrading its physical assets, such as buildings, equipment, and technology infrastructure. OpEx, on the other hand, refers to the ongoing expenses that a company incurs in order to keep its operations running smoothly, such as salaries, rent, utilities, and maintenance. Understanding the difference between CapEx and OpEx is critical…